Introduction

Best 1-year fixed rate bonds are an attractive option for investors looking to secure their money with a stable return. Fixed-rate bonds are a type of investment where you lend your money to a government or corporation for a set period, and in return, you receive interest at a fixed rate.

If you are looking to invest for a short term and prefer less risk, 1-year fixed rate bonds can be an ideal choice. In this article, we’ll explore the benefits, features, and top picks for best 1-year fixed rate bonds to help you make an informed decision.

What Are 1-Year Fixed Rate Bonds?

Best 1-year fixed rate bonds are bonds that offer a guaranteed interest rate over a one-year period. These bonds can be issued by governments, banks, or corporations.

The main appeal of these bonds is their predictability. With a fixed rate, you know exactly how much interest you will earn by the time the bond matures in one year. This makes them a reliable investment option, especially for risk-averse investors.

Benefits of Investing in 1-Year Fixed Rate Bonds

Investing in best 1-year fixed rate bonds offers several advantages:

- Low Risk: Since the interest rate is fixed, you don’t have to worry about market fluctuations affecting your returns.

- Guaranteed Returns: Unlike stocks, where returns are uncertain, you know the exact amount of interest you’ll earn with these bonds.

- Short-Term Commitment: A 1-year bond is a relatively short commitment, making it a flexible choice for investors who prefer not to lock their money away for too long.

- Diversification: Adding bonds to your investment portfolio can help balance risk, especially if you already have investments in equities or other high-risk assets.

How Do 1-Year Fixed Rate Bonds Work?

When you purchase a best 1-year fixed rate bond, you essentially lend money to the issuer. In return, the issuer promises to pay you a fixed interest rate over the course of one year. At the end of the year, the bond matures, and you receive the principal amount back. The interest payments, typically made semi-annually or annually, provide a predictable income stream throughout the year.

Factors to Consider Before Choosing the Best 1-Year Fixed Rate Bonds

Before selecting best 1-year fixed rate bonds, it’s essential to consider several factors:

- Interest Rate: The higher the interest rate, the more you’ll earn. However, make sure the rate is competitive compared to other options in the market.

- Issuer: The financial stability of the issuer is crucial. Government bonds are usually considered safer than corporate bonds, but they may offer lower interest rates.

- Tax Implications: Interest from bonds may be subject to tax, so consider how taxes will affect your returns.

- Liquidity: Unlike savings accounts, bonds can’t easily be cashed out before maturity. Consider whether you’ll need access to your money during the investment period.

Top 1-Year Fixed Rate Bonds for 2025

Here are some of the best 1-year fixed rate bonds available in 2025:

- UK Government Bonds: Known for their safety, UK government bonds typically offer low-interest rates but are a great option for risk-averse investors.

- High-Yield Corporate Bonds: These bonds, issued by reputable companies, tend to offer higher interest rates. However, they come with more risk than government bonds.

- Online Bank Bonds: Many online banks offer competitive rates on 1-year fixed rate bonds. These bonds are relatively safe and can offer higher returns than traditional banks.

- Municipal Bonds: Issued by local governments, municipal bonds can offer tax advantages, making them an attractive option for certain investors.

Risks Associated with 1-Year Fixed Rate Bonds

Although best 1-year fixed rate bonds are relatively safe, they still come with some risks:

- Issuer Risk: If the issuer defaults, you could lose some or all of your investment. Government bonds are usually safer, but corporate bonds carry more risk.

- Inflation Risk: If inflation rises above the interest rate of your bond, the real value of your returns could be diminished.

- Interest Rate Risk: While fixed-rate bonds protect you from fluctuating market rates, they could become less attractive if interest rates rise significantly during the year.

How to Buy 1-Year Fixed Rate Bonds

Buying best 1-year fixed rate bonds is straightforward. You can purchase them through:

- Banks: Many banks offer fixed-rate bonds. Check their websites or visit a branch to find the best rates.

- Government Auctions: In some countries, you can purchase government bonds through public auctions.

- Brokers and Investment Platforms: Online investment platforms and brokers allow you to buy a variety of bonds, including fixed-rate bonds, often with low fees.

- Direct Purchase from Issuers: Some large corporations and banks allow you to purchase bonds directly from them, cutting out the middleman.

Understanding Bond Yields and How They Affect Your Investment

Bond yield is the return you earn from a bond investment, typically expressed as an annual percentage rate (APR). For best 1-year fixed rate bonds, the yield is usually equal to the bond’s interest rate. However, yield can fluctuate based on the bond’s price and market conditions. Keep an eye on bond yields to ensure you’re getting the best return for your investment.

Tax Considerations for 1-Year Fixed Rate Bonds

Interest income from best 1-year fixed rate bonds may be subject to taxes depending on the country where you reside. For example:

- Taxable Bonds: Corporate bonds and many government bonds are taxable at your regular income tax rate.

- Tax-Free Bonds: Some bonds, such as municipal bonds in the United States, may offer tax advantages, allowing you to avoid paying federal or state taxes on your interest earnings. It’s important to factor in these tax implications when calculating your overall return on investment.

Is a 1-Year Fixed Rate Bond Right for You?

Whether best 1-year fixed rate bonds are the right investment for you depends on your financial goals and risk tolerance. If you are looking for a low-risk, short-term investment option, these bonds can be a good fit. However, if you’re willing to take on more risk for potentially higher returns, other investment options such as stocks, mutual funds, or long-term bonds might be better suited to your needs.

Comparing 1-Year Fixed Rate Bonds to Other Investment Options

When considering the best 1-year fixed rate bonds, it’s helpful to compare them to other investment options:

- Savings Accounts: These accounts offer similar safety but typically provide lower interest rates than bonds.

- Certificates of Deposit (CDs): CDs are similar to bonds in that they offer a fixed rate of return. However, CDs may have a fixed term longer than one year, and early withdrawal could result in penalties.

- Stocks: While stocks can provide higher returns, they come with greater risk and volatility, making them less suitable for short-term goals.

How to Maximize Returns on 1-Year Fixed Rate Bonds

To maximize your returns from best 1-year fixed rate bonds, consider:

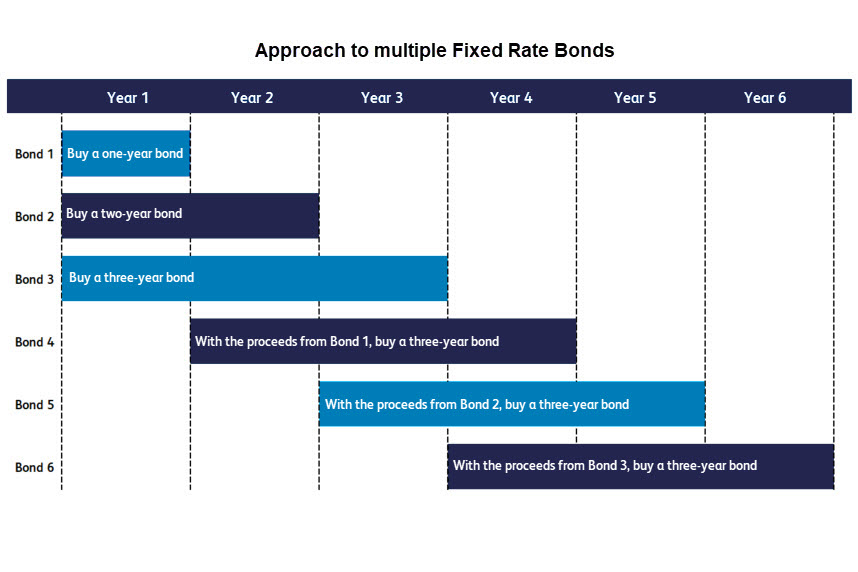

- Reinvesting Your Earnings: Instead of withdrawing your interest payments, consider reinvesting them to take advantage of compound interest.

- Shopping for the Best Rates: Interest rates vary between issuers. Compare rates across multiple banks, online platforms, and bond types before making a decision.

- Tax-Efficient Bonds: If you’re in a high tax bracket, consider tax-advantaged bonds to reduce your tax liability.

The Future of 1-Year Fixed Rate Bonds

As interest rates and inflation fluctuate, the future of best 1-year fixed rate bonds will depend on the broader economic conditions. If inflation continues to rise, bonds with higher interest rates may become more attractive. However, if the economy stabilizes, the returns on fixed-rate bonds may decline. Keep an eye on market trends to determine the best time to invest in bonds.

Conclusion

In conclusion, best 1-year fixed rate bonds provide a low-risk, stable investment option for short-term financial goals. By understanding the key features, risks, and benefits of these bonds, you can make an informed decision that aligns with your financial needs.

Always compare rates, consider the issuer’s credibility, and be aware of tax implications to ensure that your bond investment works for you. With careful research and planning, best 1-year fixed rate bonds can be a secure and profitable way to grow your savings.